I wanted to run an experiment to sell my house as for-sale-by-owner (FSBO) so I could write a guide and see how tough or easy it is to sell my house in Arizona without a realtor. Here is my story and I hope it serves as a For-Sale-By-Owner (FSBO) Guide for home sellers.

For full transparency, I’ve sold several homes in Casa Grande, Arizona with a realtor and I prefer it because it enables me to focus on my core business. They are like legal help; realtors have access to contracts and systems that make the selling process streamlined… but I pay handsomely for it.

Day 1

I looked at comparable properties in Casa Grande, Arizona that had sold in the last 6 months on Zillow and choose a price the was slightly higher than average and I listed the property on Zillow. Comparable properties on MLS like Zillow can be used as a guide in pricing your property. The pictures that were used for the listing were taken with my phone at dusk. The pictures come out best as the sun is setting or rising.

It was great to find that since Zillow owns Trulia, my listing showed up on Trulia as well. This made it easier for me to sell my house. I did not tag is as merely “For Sale” but put it as a “For-Sale-By-Owner” also known as FSBO.

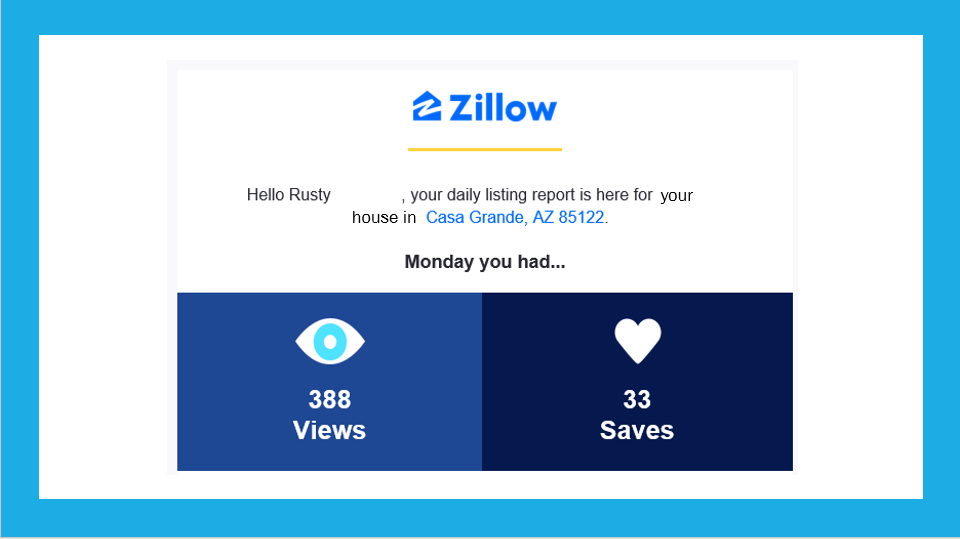

In one day, my for-sale-by-owner property had 388 views and 33 saves. This was impressive. To my surprise, I received a full price offer on day 1! Congratulations me! Now, this is where the realtor would have been useful. It turns out that realtors like to work with other realtors that have access to the same tools and know the drill… A realtor can serve as a paid guide in the traditional way of selling a house.

The full-priced offer contained a contingency to sell a house that was not under contract… they wanted 2 months to sell their own house and then buy mine. I wasn’t excited about the possibility of the buyer’s house not selling and I am sitting on a vacant house for two months that I am not able to sell my house.

I called the buyers agent and told her that I wanted the earnest money to be non-refundable. This would enable me to essentially rent my house to them while we were going through the process.

Now, what form do I use to complete this counteroffer? I don’t have access to the realtor software to easily do this or serve as a guide. When I spoke to the realtor about my counteroffer, she made it very clear that she wasn’t interested in writing up my counteroffer. So, I found a generic offer contract online to use as a guide and filled in all the terms that the sellers agreed to as well as the non-refundability. This was contract was not satisfactory to the buyer’s agent. The agent started pushing earn an extra 1% ($1,700) to fill out the counteroffer document. I wasn’t interested in paying $1,700 for one document.

Day 2

The next day, while I was struggling to create a counteroffer document, I received another offer that was 5k above asking price and had more favorable terms. I let the first agent know that a better offer had come in and I was going to accept it.

I signed up for a free trial with Docu-Sign. This enabled me to digitally sign the contract PDF file with the second offer and send it back immediately. I emailed the signed contract to the buyers realtor and my title/escrow agent. I have a good friend that is an escrow agent at the title company near my house in Casa Grande, Arizona. Prior to the submission of the 2nd offer I asked the buyer’s agent to use her for the transaction. He accommodated. This is important. I live in Casa Grande, AZ and the house for sale is in Casa Grande, AZ. It makes sense that the transaction would occur in Casa Grande, Arizona. Yet, often the buyer’s agent tries to use a title company 30-40 minutes north in Phoenix.

Day 3

The escrow agent emailed me a confirmation when the buyer submitted earnest money. Once the earnest money is submitted, the contract is in full effect. The ten-day inspection period is started. This is the time that a home inspector will inspect the home and arm the buyer with negotiating power. The buyer will submit a list of requested repairs of the home. It will come in the form of the BINSR. Hopefully, since I rehabbed this Arizona house, the requested repairs will be minor.

Now, during the inspection period, the seller (me) needs to fill out an Arizona State SPDS. The SPDS is a disclosure form that the seller discloses any repairs and problems that he house has had during ownership. The seller is also required to request an insurance claims report from the house insurance company and get it to the buyer.

Day 6

The appraiser and property inspector called to schedule walkthroughs.

Day 8

The house inspector performed the inspection and the buyer submitted a list of repairs. The repairs were reasonable, so I printed off the BINSR doc and signed it to accept the repair request.

Day 15

The appraisal was completed and the appraised value matched the purchase price. Nice!!! That simplifies the process.

Everything is going smoothly right now. My biggest fear is the fact that our contract is only viable if the buyer can sell their house in California. Fingers crossed.

Day 17

I signed closing documents with the title company to officially sell my house. This requires a bunch of reading. I try to take my time and learn something while signing my closing documents.

Check out this other article for additional info on the differences between for-sale-by-owner and hiring a real estate agent:

4 Reasons Why It Is Better To Sell Your House Directly vs. Hiring A Casa Grande Real Estate Agent

By Rusty Rueckert

Terms of an Arizona Real Estate offer to consider:

I learned a lot of terms when I did sell my house without a realtor. Here are few terms of the contract/offer to understand before signing I want to share with you to guide you.

Earnest money: I like to see 1% of the purchase price as the earnest money. If the buyer is serious about buying the house, they will be willing to cut a check for a few thousand.

Contingencies: Often the buyer needs to sell their house before they buy the next house. Contingent offers make it possible for the buyer to back out of the contract if their house does not sell. Clearly, an offer without contingencies is better.

Closing costs: There are three options: Seller pays all, buyer pays all, even split. Traditionally, the buyer and seller split the title and deed transfer fees. The fees are usually around $1,500-2,000.

Inspection period: traditionally the buyer requests a 10 day inspection period. A shorter inspection period is better for the seller. If the buyer finds something during the inspection that they don’t like, they will cancel the offer. The sooner this happens, the better.

House Warranty: Most buyers request a warranty. Warranties usually cost around $500. This is negotiable.

Seller Concessions: Often buyers will ask the seller to offer a credit to pay for their loan closing costs. I know… it sounds weird… Why would I pay for the buyer’s loan closing costs? At the price point that I sell at, it is usually part of the deal. Many buyers do not have much cash. I have seen buyers ask for anywhere from 0 to 3% of the purchase price.

Type of Financing: There are many ways to buy a house. The buyer may have 20% of the purchase price and qualify for a conventional loan or they may only have 3.5% and qualify for an FHA loan. The buyer may buy with cash. A cash offer is the quickest way to close and avoid hiccups in the transaction. If the buyer is a cash buyer, an appraisal is not needed. Cash offers are best.

Buyer Agent Compensation: The buyers agent brought us a buyer, so we should give the agent the customary 3%. This is written in the contract/offer.

Appraisal: when a lender is involved, an appraisal will be ordered to ensure that the value of the home is at or above the value of the house. The lender will only lend up to the amount of the appraised value of the house. When the buyer is a cash buyer with a cash offer, an appraisal is not needed. The appraisal usually takes a couple of weeks.

If you want to “sell my house fast” in Arizona, aside from considering listing your house as a for-sale-by-owner (FSBO) property in Zillow, you should also consider selling directly to professional buyers like Rusty and Susanna who have over a decade of experience to guide you through a quick and easy process of selling your house.

You can also check out this Free Guide: Pros and Cons Of Selling To A Professional Home Buyer.